Last week, Vale of Clwyd MP Dr James Davies called on the Chancellor to remove the unfair 20% tax on eBooks and audiobooks that hits young readers and people living with physical disabilities.

The Government has never applied tax to print books or newspapers to safeguard access to knowledge and free exchange of ideas. However, this principle has not been extended to eBooks and other digital reading materials. The result of this tax anomaly is that those who need or prefer to read digitally are taxed 20% more.

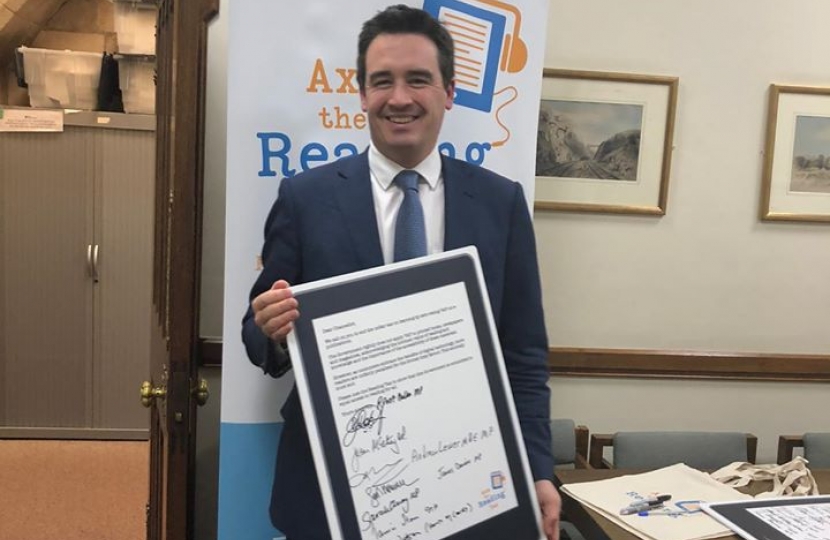

James is one of a number of MPs who has signed a letter to the Chancellor urging him to axe the tax.

He said: “No MP voted for this tax, which acts as a barrier to childhood literacy and penalises people who need or prefer to read digitally. It is vital that children and young people in the Vale of Clwyd have access to reading across all formats in order to learn.

“It is also essential that people with a physical disability, including the estimated 2 million people living with sight loss, can access the joys of reading. For this reason, I am proud to support the campaign to Axe the Reading Tax and call on the Government to remove VAT on digital reading materials”.

Until 2019, the EU blocked any reduction in VAT on eBooks. However, in December 2019, EU law changed to allow member states to bring VAT on digital publications in line with the VAT charged on their print counterparts. 18 EU member states have since made this change including Ireland, France, Germany, Italy and Spain.

The 20% tax on e-publications hits children and young people particularly hard as over 45% of children prefer to read on a digital device, with young people from low income backgrounds more likely to read digitally. This tax also disproportionately impacts the elderly and people with disabilities who often struggle to read or handle print books.