Vale of Clwyd MP, Dr James Davies, has welcomed today’s budget – saying it will benefit people right across North Wales.

The budget, which comes at a time of concern over the Covid-19 Coronavirus outbreak, will provide the Welsh Labour Government with a £360m increase – allowing further increases to the NHS budget, spending on flood defences and investment in other public services.

James praised the Chancellor’s approach to the Coronavirus – moving to protect small businesses and workers from the financial effects of the outbreak – but he called on the Welsh Government to replicate those elements which are devolved, including measures on business rates and grants.

He said:

“Increases in the National Insurance threshold and the National Living Wage will mean families keep more of the money they earn. The measures mean that someone working full-time on the minimum wage in the constituency will be over £5,200 better off compared to ten years ago when the Conservatives came into office.”

The budget pledges a £5bn fund for gigabit-capable broadband rollout, with a focus on “hard to reach areas” – something that will be welcomed across the region. It also creates an entitlement to Neonatal Leave and Pay to support parents with the stress and anxiety of having a baby in neonatal care, and provides £10m to Armed Forces Covenant Trust fund. Additionally, there is a promise to reduce Personal Independence Payment reassessments for those whose conditions are unlikely to change.

James was particularly pleased to see campaigns he had supported being acknowledged in the budget, including:

- Freezing of fuel duty for 10th successive year, saving the average driver a cumulative £1,200 compared to pre-2010 plans.

- Freezing of duty on beer, cider, wine and spirits.

- A £2bn commitment to increase the NHS Pension tapered annual allowance which has discouraged senior doctors from working shifts.

- VAT relief for S4C, worth approximately £15m a year to the broadcaster.

- Abolition of the tampon tax now we have left the EU.

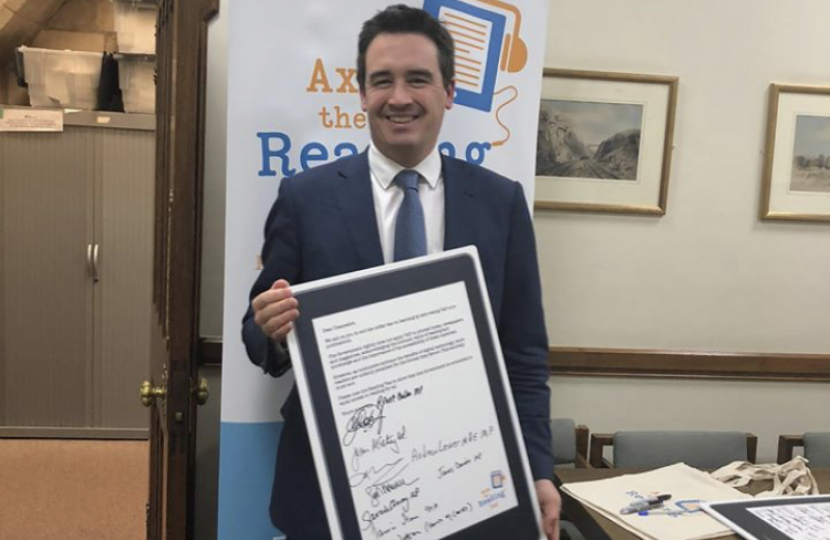

- Abolition of tax on ebooks and audiobooks and of the “motorhome tax”.

- Retention of “red diesel” tax savings for agriculture.

- Measures to increase the recycling of plastic and to make the use of electric vehicles affordable and practical.